Spaceship CGT Discount Calculator

Transparent, Powerful, Yours.

Calculate Capital Gains Tax fast with open, customisable Python code.

One-time purchase — unlimited use, total control.

Spaceship investors are missing out on CGT savings

And here's the catch - buried in Spaceship's fine print:

"We haven't taken into account your eligibility for the CGT discount and other considerations that might be relevant to you."

Years of investments

Spaceship ignores CGT discount

No transaction export

You pay more tax than you should

Everything you need to save at tax time

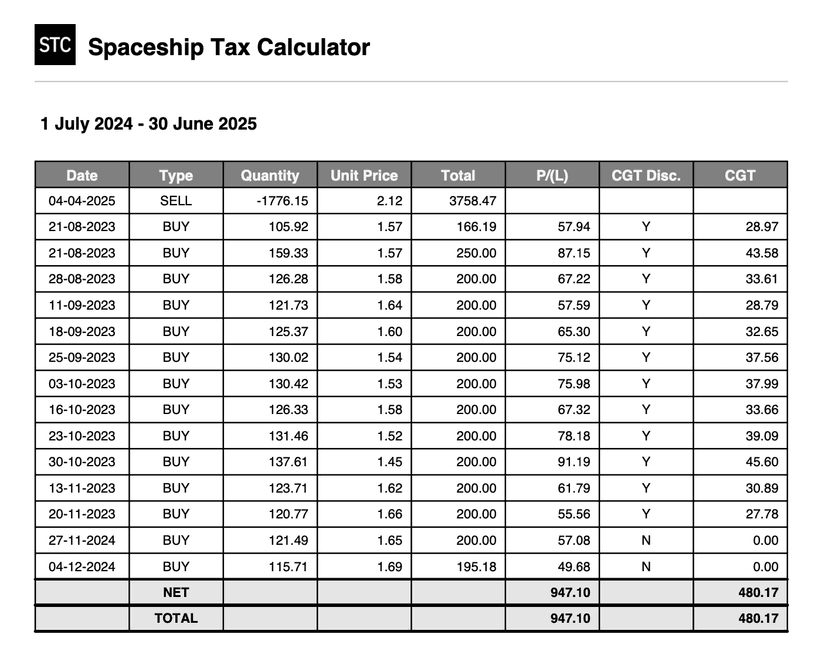

CGT Calculator

Automatically calculate your Capital Gains Tax (CGT) discount for sold investment units with precision.

Tax Reports & Analysis

Generate comprehensive financial year reports with detailed, itemised tax breakdowns using FIFO method.

FY 2024 Tax Report

Full breakdown with FIFO calculations

$1,245.60

Tax owed

FY 2023 Tax Report

Detailed itemised breakdown available

$892.30

Tax owed

FY 2022 Tax Report

Historical records with full transparency

$456.90

Tax owed

Export Options

PDF reports and CSV exports for portfolios across all financial years for record keeping.

PDF Report

Professional tax reports

CSV Export

Transaction data for records

Advanced Features

Complete Spaceship portfolio support, unrealised gains insights, and intelligent CGT discount forecasting.

All Spaceship Portfolios

Universe • Earth • Origin • Galaxy • Explorer

Unrealised Gains

Analyse potential gains before selling

And so much more...

Coming Soon • Smart sell timing

Flexible & Transparent

Source code included with full transparency. Review, modify, or extend the calculator to adapt to your unique tax needs.

</>

Source Code Included

Review, audit, or extend the code as you wish

Perfect for power users, accountants, and developers

Pricing

Not another subscription.

Lifetime Access

Pay once for lifetime access to the code & any updates.

$99

$49

AUD

- CGT discount calculator

- All financial years

- Supports all portfolios

- Export transactions to CSV

- PDF report generation

- Unrealised capital gains calculator

- Detailed FIFO breakdown

Pay once. Save tax forever.

Frequently Asked Questions

You get a complete Python-based tax calculator that:

- Connects directly to Spaceship's internal API

- Calculates your Capital Gains Tax (CGT) discount automatically

- Generates comprehensive tax reports for all financial years

- Exports your data to CSV and PDF formats

- Works with all Spaceship portfolios (Universe, Earth, Origin, Galaxy, Explorer)

Plus lifetime access to all future updates and improvements.

Spaceship's standard tax reports are missing several key features:

- No CGT discount calculations included

- No CSV export functionality

- No public API for advanced users

This leaves investors with incomplete data and forces manual calculations during tax time.

Absolutely. Your data security is our top priority:

- The calculator runs entirely on your local machine

- No data is stored on our servers

- Uses the same secure connection as logging into Spaceship directly

- You can review all code operations for complete transparency

Your information stays private and secure, just like when you access your Spaceship account.

Since Spaceship doesn't provide a public API, we use their internal API to access your data. We chose a code-based approach for several reasons:

- Transparency: You can see exactly what the code does

- Security: Your data never leaves your computer

- Control: You can modify and customise the calculations

- Reliability: No dependency on external web services

No, you don't need to be a Python expert! We've made it as simple as possible:

- Clear step-by-step instructions included

- Video tutorial showing exactly how to run the code

- All dependencies and requirements listed

- Support available if you get stuck

Basic computer skills and the ability to follow instructions are all you need.

The calculator works with all Spaceship Voyager portfolios:

- Universe Portfolio

- Earth Portfolio

- Origin Portfolio

- Galaxy Portfolio

- Explorer Portfolio

You can process each portfolio separately or combine them for a complete tax picture.

Our calculations are 100% accurate and follow Australian tax law:

- Uses the official FIFO (First In, First Out) method

- Applies the correct 50% CGT discount for assets held over 12 months

- Handles all transaction types (buys, sells, distributions)

- Matches ATO requirements for tax reporting

The same calculations your accountant would use, but automated and instant.

We're here to help! You can:

- Email us directly for support

- Check the included documentation

- Watch the video tutorial

- Review the code comments for guidance

We're committed to making sure you can successfully use the calculator.

Transparent, Powerful, Yours.